“The main aim is not to control the employees’ funds but rather to increase their retirement savings. This is the government’s way to deter employee debt eradication through relying on their pension funds.”

Investment Management Professional, Yvonne Freely, clarifies the intention behind the two-pot system.

The two-pot system has arrived with new lids, some of which you can open while working and the others not so much. Are you ready for the new two-pot system? A secured pension is the motivation for enduring the work week, but this new South African law stirs the pot. What you may not know is that this law has been in the making since 2019 with the backing of labour unions to ensure financial flexibility and security for workers. Get to know how the new two-pot law will affect your retirement.

Yvonne Freely, an expert in investment management, met with Boni. Yvonne is a graduate of the University of Cape Town with a Bachelor of Commerce (Honours) in Financial Analysis and Portfolio Management. She has extensive expertise in venture capital, private equity, and listed equity. To top it all off, Yvonne is pursuing both an MBA and a CFA designation.

What is the two-pot retirement system?

“The two-pot retirement system is a new law reform that affects retirement fund processes, inculcating workers into saving more towards their retirement as some workers leave work prematurely due to financial pressures. So the new system hopes to alleviate the turnover of employees who solely leave work to have early access to their retirement funds for emergency purposes.”

Secondly, it is the government’s way of increasing the percentage of pensioners with secured savings rather than being broke and exposed to predatory lending or ultimately depending on government grants for the rest of their lives.” Yvonne explained.

“But how is this system helpful if employees have debts in the hundreds of thousands but can only pay 10% of their existing retirement funds? asks Boni, who knows exactly what the audience will be thinking about. Yvonne reminded us that paying debt is not an emergency because debt has a timeline for repayment. While she is not in a position to know what one’s emergencies could be, she continued to give us examples of emergencies such as medical care or having to travel for an emergency surgery. She further noted that the typical South African lifestyle is unpredictable, and many employees could argue that with inflation at its highest, paying off debt is an emergency for them.

How does the two-pot system work?

Well, here’s where it gets tricky, so listen carefully to Yvonne’s words. “There are three pots: the vested pot, the savings pot, and your retirement pot. Your vested pot consists of your old funds, which you will have been contributing to before the new law. From September 1, 2024, you will have two new shiny pots to contribute to. However, if you wish to withdraw from your retirement before September 1, 2024, you will only be able to withdraw a maximum of 10%, which is capped at R30,000.

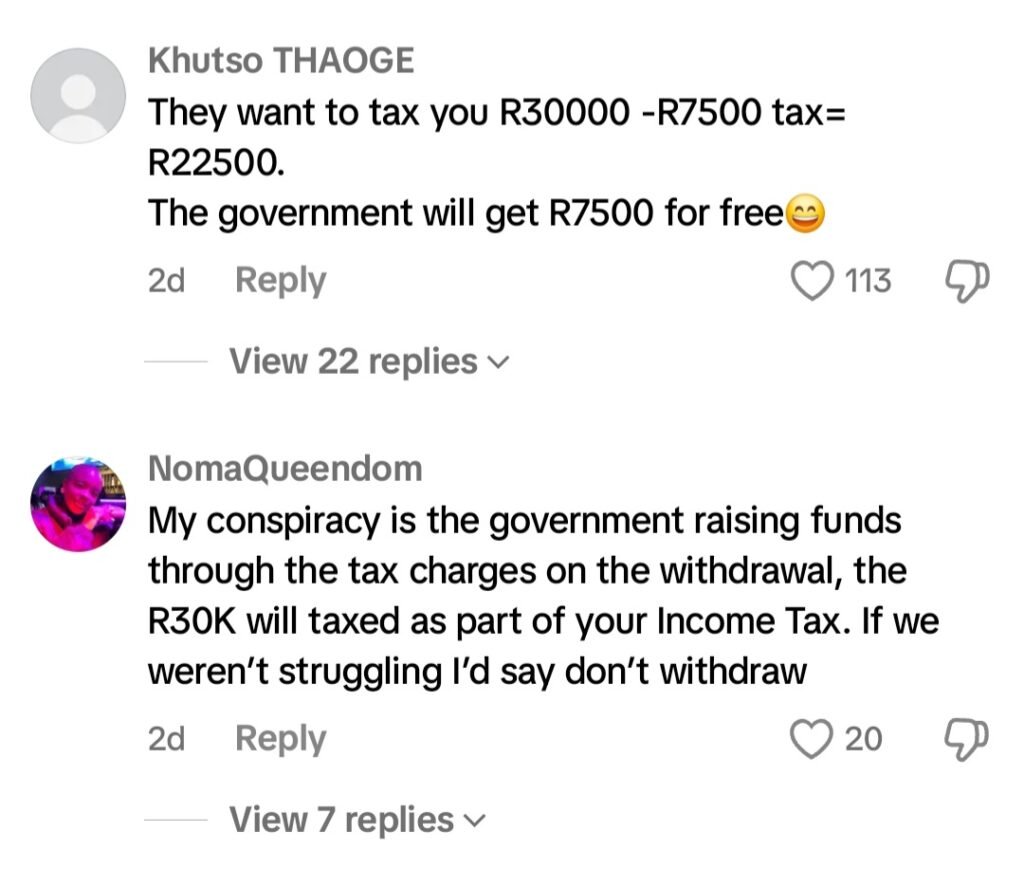

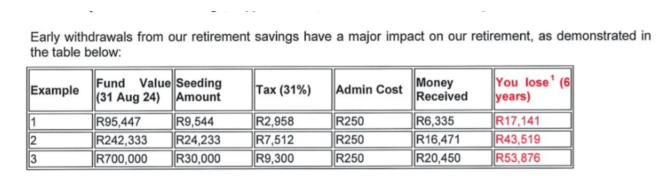

The cap of R30 000 has upset a few because, depending on your tax bracket and fund administration costs, you may receive less than R18 000.

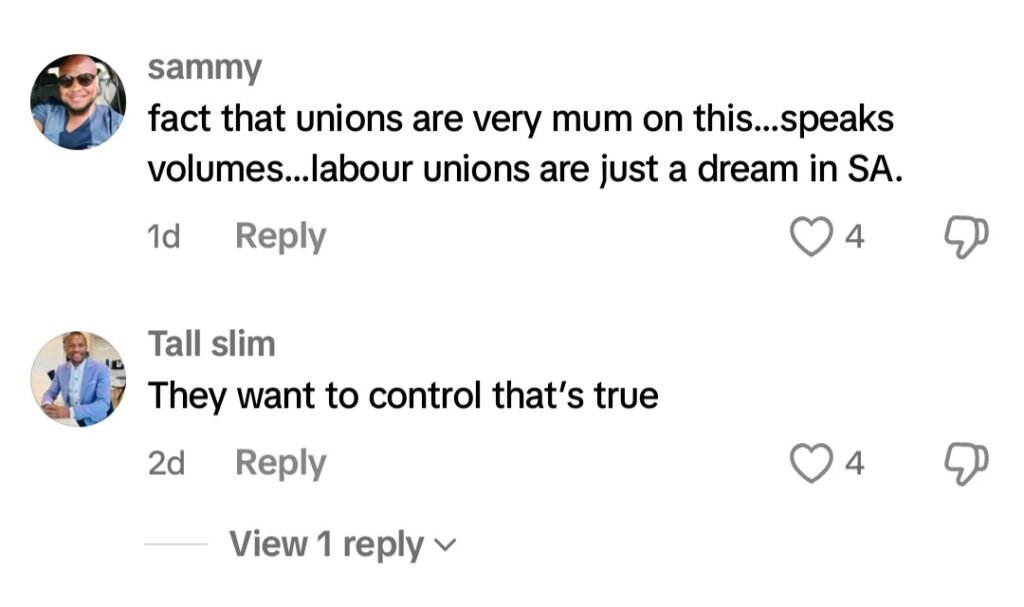

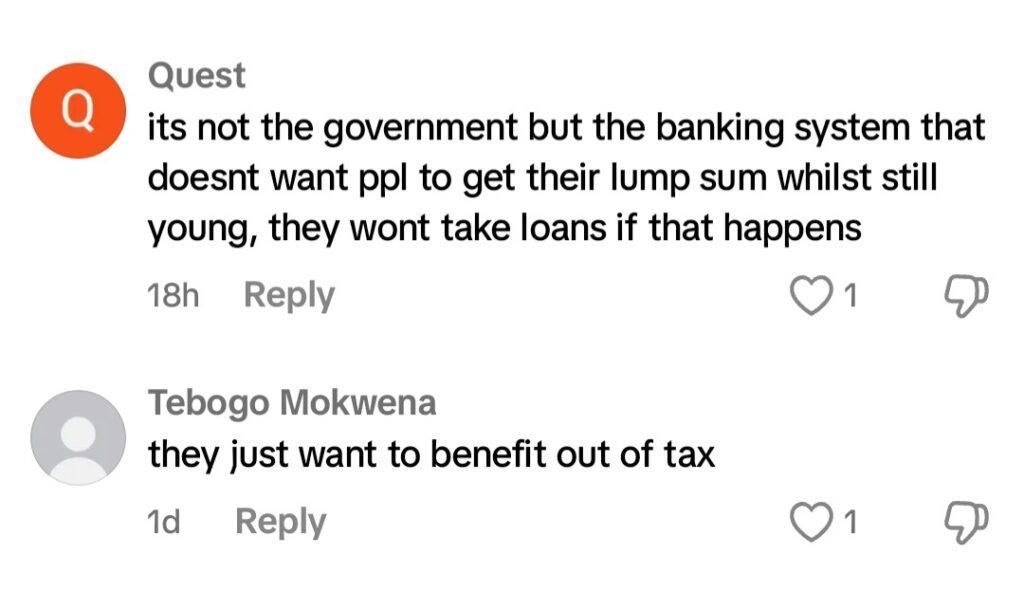

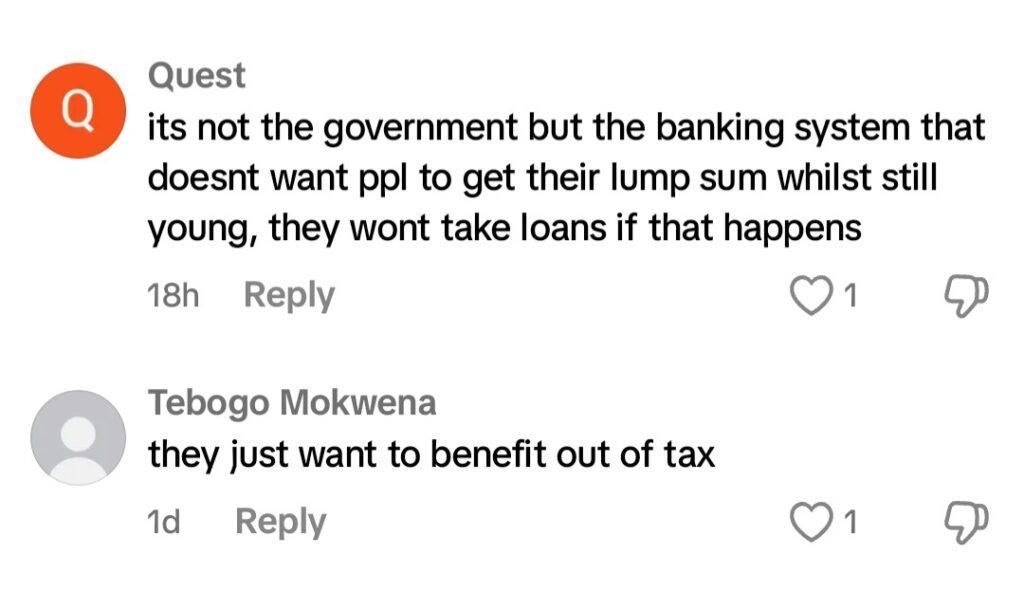

“However, this is the government’s way of ensuring that you have more funds to channel into your retirement pot, which will increase exponentially with compound interest.” Yvonne emphasised, but the comments below are not happy at all about this new law.

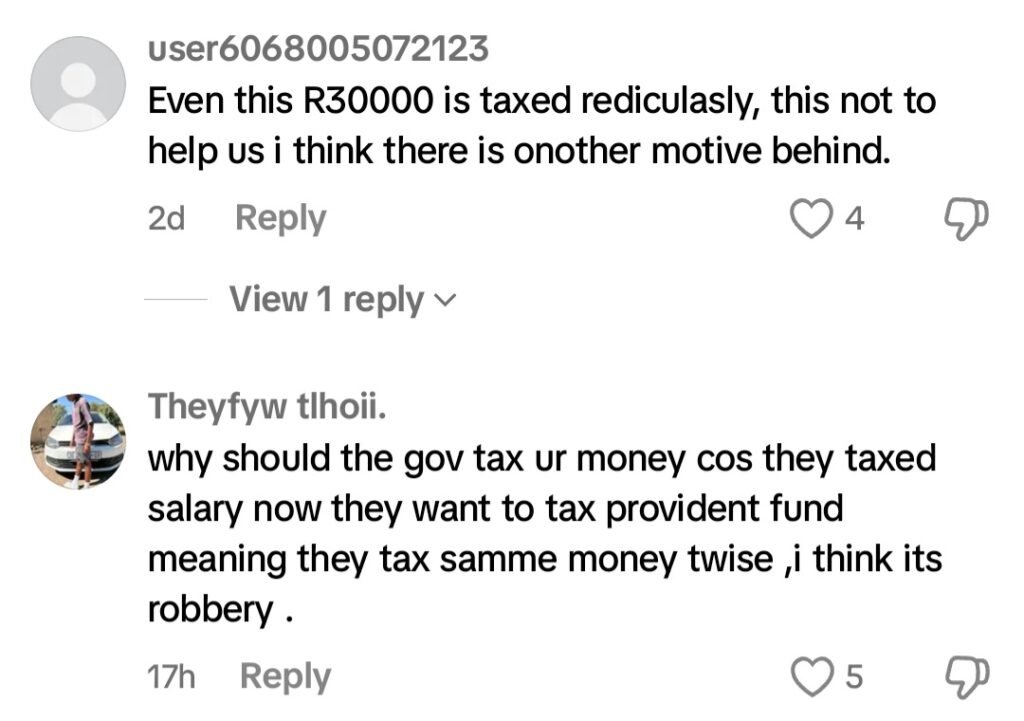

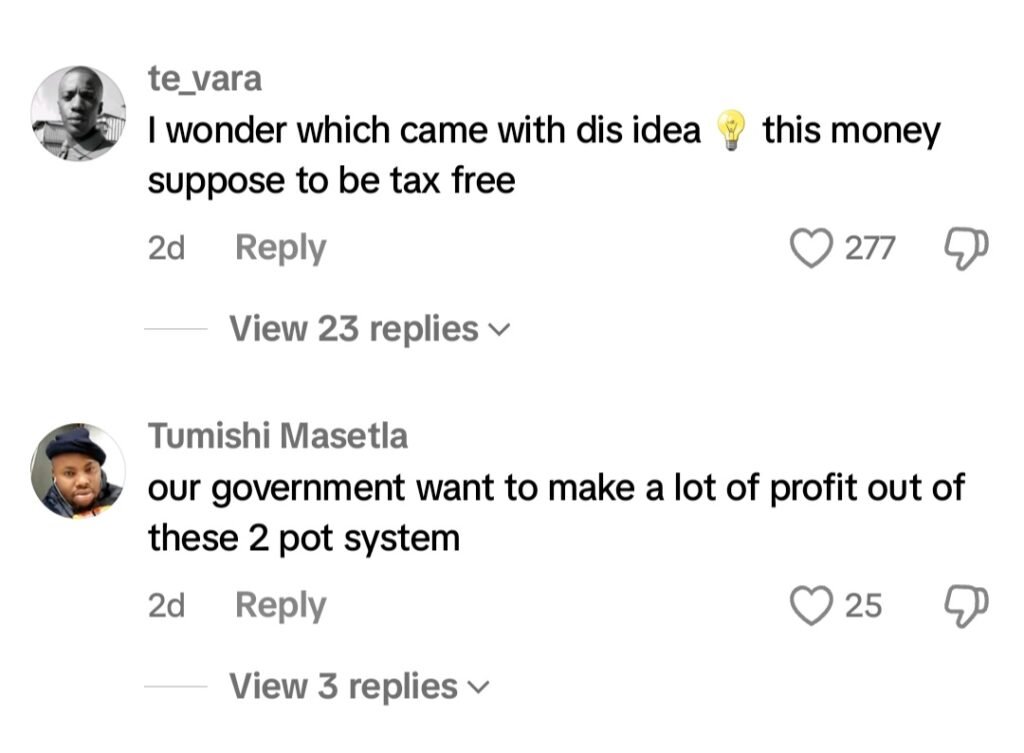

As seen above, South Africans are not amused at all, with some suggesting that there is some conspiracy by the government that might be working with the banks to ensure that people don’t have access to cash to settle their debts in order for the banks to make money!

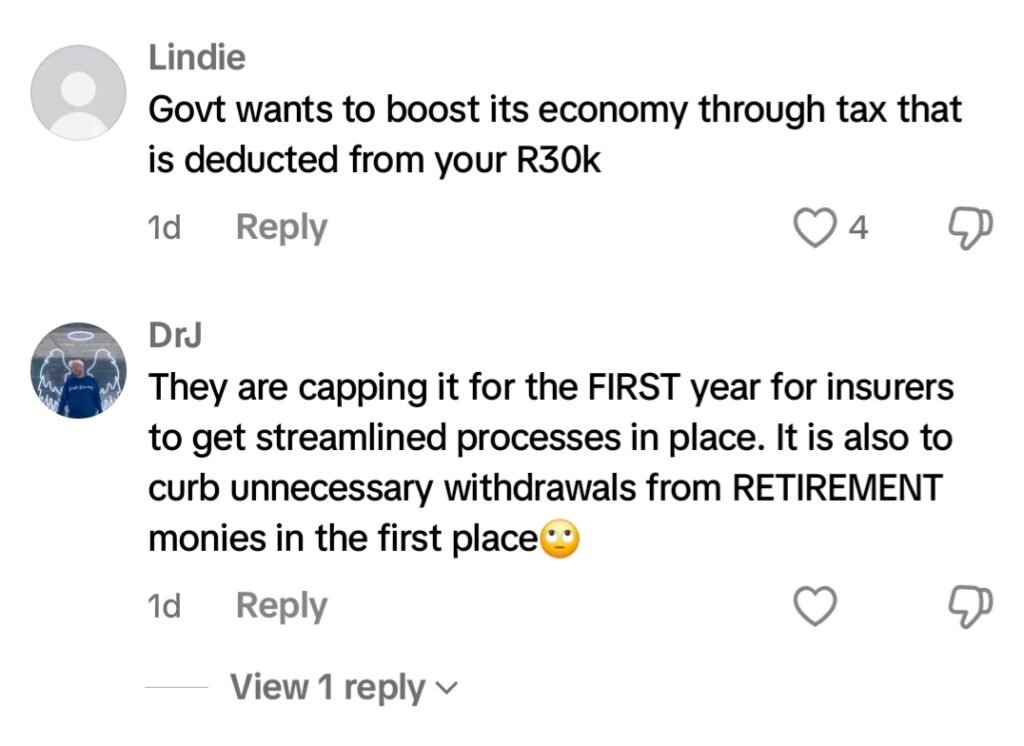

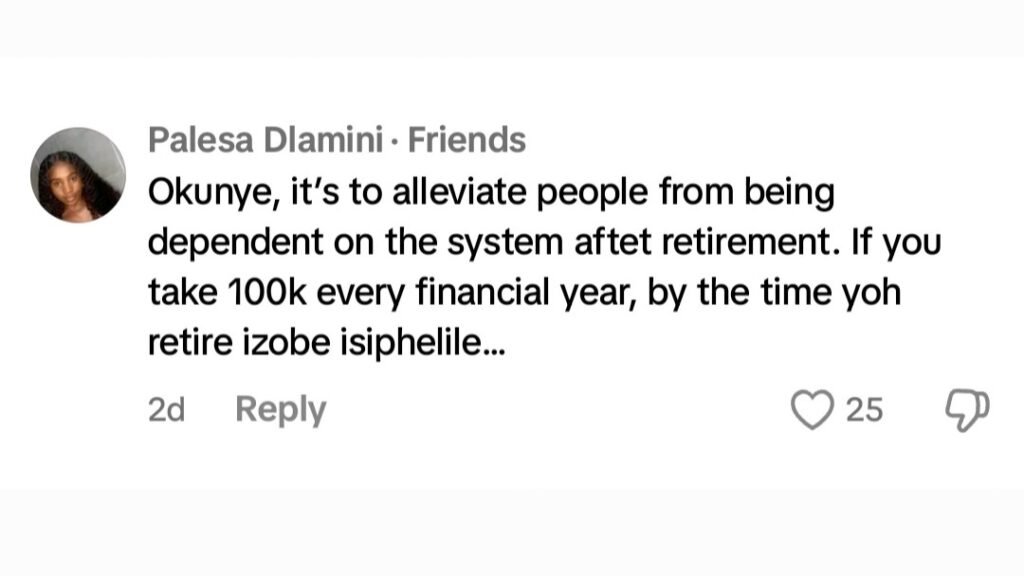

It doesn’t look all gloomy to some, as they appear to have a better understanding of what the government is trying to accomplish with this new law.

How will early withdrawals affect your retirement?

An anxious citizen who questioned the methodology used to determine the loss of years provided us with this example above. Yvonne suggested that everyone should discuss this new law with their fund manager.

You may watch the full interview below, where Yvonne Freely answered some hard-hitting questions from our audience and further explained the difference between investment management and investment banking as a career path.

If you are interested in the fundamentals of financial management, you may check out this course from UCT GetSmarter in partnership with EDx, Use promo code BONI2024 to get a 20% discount on this course or any GetSmarter courses!